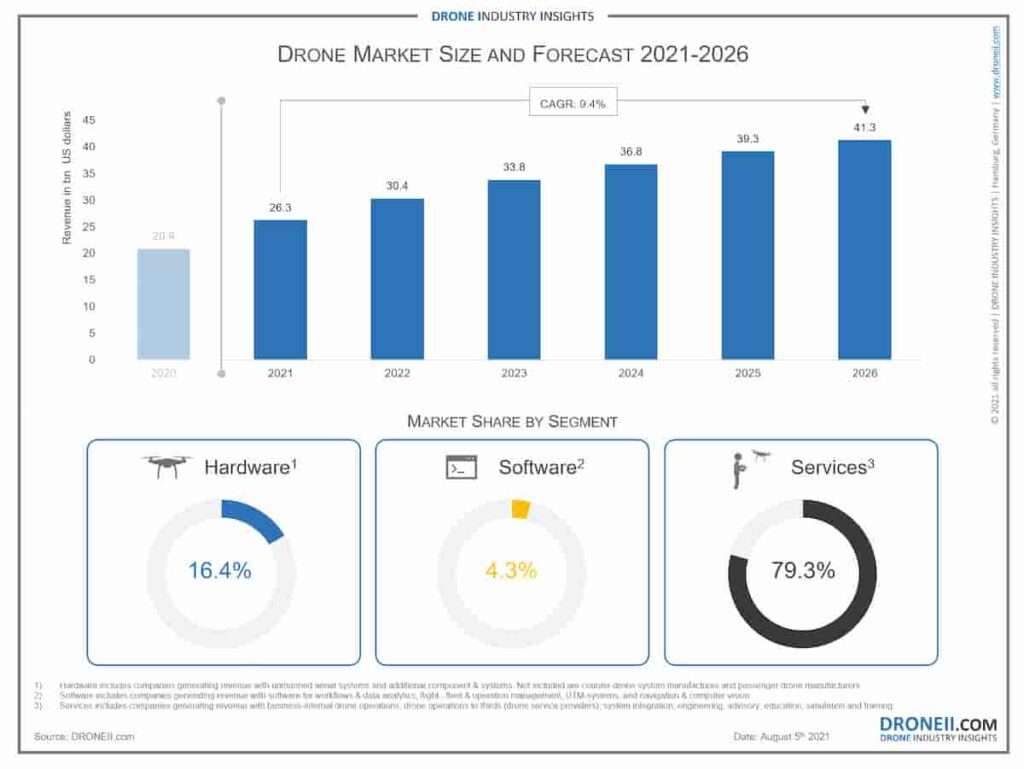

The drone market will grow at 9.4% CAGR and reach US$41.3 billion by 2026. In the grand scheme of things, the drone business is currently worth $26.3 billion and is expected to continue to rise. Drone Industry Insights market model predicts a 9.4% CAGR (Compound Annual Growth Rate) at the worldwide level, fueled primarily by commercial drone growth rather than recreational drone growth. Of course, this is lower than last year’s projection, but one reason is the impact of the COVID-19 pandemic, which we shall discuss later. The major point is that this is still a pretty steady increase, with the drone sector expected to generate $41.3 billion in sales by 2026.

To put this in perspective, the worldwide helicopter market is presently valued at US$48.2 billion, according to Statista; despite the fact that helicopters have been around for considerably longer, drones are expected to surpass this figure within a decade.

It is evident that the drone market is a service-oriented sector when it is divided into three segments (hardware, software, and services). Rather than hardware or software, services account for roughly 78 percent of global drone income. By 2026, this segment is expected to develop at a 9.6% CAGR, reaching US$30.7 billion as per the Drone Market Report 2021-2026.

[email-subscribers-form id=”1″]

Business-internal drone activities, or enterprises that use drone technology for internal business processes, drive the service category. Today, services account for more than 70% of the market, and this percentage is expected to rise in the future. Drone-Service-Providers (DSPs), who offer their services to third parties, hold the second-highest proportion (which includes deliveries, inspections, and a plethora of other applications).

The leading industry for commercial drones is still and will continue to be energy, followed by construction and agriculture. Cargo, Courier, Intralogistics, and Warehousing, not a surprise, will be the fastest-growing drone market in 2021 and beyond, with a CAGR of 24.3 percent. This is due to the growing popularity and demand for drone deliveries for both internal and external services (intralogistics and warehousing).

Given the recent news concerning drone deliveries of coronavirus test kits and medicines, this is one way the global epidemic benefited the drone sector. Drone companies grew over the entire year of 2020, which included the pandemic’s height. Despite layoffs and lower profits, the drone business remained resilient in 2021. Second, in the commercial drone arena, there was a record amount of investments. As a result, it is obvious that a lack of market activity did not deter investors from investing in drone technology.

Investors may have seen how drones might aid in the remonetization of work and the streamlining of corporate procedures. Finally, the expanded use of drones for COVID-19 test kits, vaccines, and pharmaceutical goods may have demonstrated more of the drone delivery’s potential benefits. We noticed last year that drone firms like Zipline and Wing were able to develop and scale their solutions faster than expected, and the impact is even more obvious after many more months of global lockdowns.

Asia and Latin America

If drone businesses take advantage of the increased investments and positive attention given to the technology, the industry might benefit from the well-known K-shaped rebound and grow even faster than our data predicts. Asia is the most important region for drones, with the United States and China dominating the market in 2021. The Asian market will rise to $16.5 billion, while the United States and China will grow at 6.8% and 9.7% CAGRs, respectively. The growth rates of both South America as a region and India as a country are maybe the most intriguing.